International tax for Foreign Companies in India — Overview

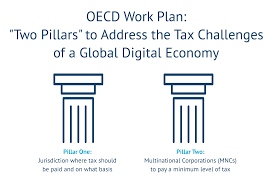

Hence, with the implementation of this reform, 25% of a company's "residual profit"—profit above the 10% margin—is reallocated to market jurisdictions. The goal of this reform is to ensure that the largest corporations pay a fairer share of taxes in the countries where they derive their revenues, even without a traditional physical presence.

Pillar Two: Global minimum tax Pillar Two establishes a global minimum effective corporate tax rate of 15% for large multinational groups. This discourages profit shifting to low-tax jurisdictions by ensuring that MNEs pay a minimum level of tax regardless of where they operate.Targeted companies include MNEs with consolidated group revenues of at least €750 million.If an MNE's effective tax rate in a given jurisdiction falls below the 15% minimum, a "top-up" tax is applied.- The two primary enforcement rules are:

- Income Inclusion Rule (IIR): The parent company is required to pay a top-up tax on the low-taxed income of its foreign subsidiaries.

- Under-Taxed Profits Rule (UTPR): It can increase taxes in other jurisdictions if the parent company's country does not apply the IIR.

- Domestic minimum tax: Countries can also introduce a Qualified Domestic Minimum Top-up Tax (QDMTT) to collect the top-up tax revenue directly.

India's Angle over the OECD Reforms

Pillar One - India has an Equalisation Levy (Google Tax) and significant digital user base.Once Pillar One is implemented, India may have to withdraw unilateral digital tax measures, but will gain rights to tax profits of global tech giants like Google, Amazon, Meta.

Pillar Two - India’s domestic corporate tax rate (22% for most companies, 15% for new manufacturing) is above 15%, so India won’t lose out.But Indian MNEs with subsidiaries in low-tax jurisdictions (like Mauritius, Singapore, UAE, Cayman) will be impacted.

Countries with Major Impact

- Countries like Cayman Islands, Bermuda, British Virgin Islands, Mauritius, Jersey, Guernsey, Bahamas are worst hit.Their zero/ultra-low corporate tax models collapse because MNEs will face top-up taxes in parent jurisdictions.Loss of attractiveness as holding or profit-shifting hubs

- A few other impacted countries include Singapore, Switzerland, United States, Ireland and United Arab Emirates (UAE) as their effective tax rate falls below the minimum tax rate of 15%

- United States has a Loss of taxing rights as profits shift out of the US to consumer markets (India, EU, emerging economies).

- European Union gains taxing rights on global MNEs selling into EU markets.

Consult with A2consultants to explore our indepth knowledge and insight on OECD Pillar One and Pillar Two

A2consultants Indian Business Companion is also available on ChatGPT, making it more accessible for Professionals, Businesses, and Foreign Entities seeking insights into the intricate tax challenges you can acess from this link

Book a Free consultation

https://chatgpt.com/g/g-6865f276fc1c8191b467aa48f145a369-a2consultants-india-business-companion.

Scan Here to Know More with ChatGPT